Andex Charts, Passive Charts, Active Charts Oh My.

Here is a list of stories we are discussing in detail on tonight’s breath taking episode of the #BecauseMoney Podcast and a chart for your viewing pleasure.

Jackson Middleton

Jackson Middleton

Owner

Fellowship of the Andex Chart | Because Money Podcast Episode 10 News List

Listly by Jackson Middleton

Here is a list of the stories discussed on the Because Money Podcast Episode 10

You're ready to start investing. What ETFs should you include in your portfolio? Rob Carrick finds out

Mutual funds get little love from media critics and consumer advocates. But that hasn't hurt sales. Canadian mutual fund companies managed $999.2 billion in assets at the end of December. The $1 trillion mark - similar to Mount Everest's peak - should be reached later this month.

There are many reasons why relatively few Canadian investors use ETFs compared with actively managed mutual funds. There's about $900 billion in mutual funds in this country, while ETF assets total about $60 billion-just over 6% of the total.

Okay, last week we talked about how the small things add up and how neglecting your automatic payments is a really bad idea. I want to expand on that idea a little bit as we are almost done transferring all our bank accounts to no fee banking.

Episode 10 of the Because Money Podcast. Topics will include: - Build a low-cost, broadly diversified portfolio - The disturbing news that ETFs lost ground to mutual funds last year - Will mutual fund advisers soon be selling ETFs? - Does anyone still use the First Time Home Buyers Plan?

The $25,000 Ottawa allows you take out of your retirement fund to buy your first home sure doesn't go as far as it used to. Under the home buyers' plan, Canadians can take $25,000 out of their registered retirement savings plan and pay it back over the next 15 years without incurring any penalty.

Jackson Middleton

Jackson Middleton

Owner

Season 1 | Because Money Podcast | All Episodes

Listly by Jackson Middleton

Here is the list of all 27 episodes from Season 1 of the Because Money Podcast. Hosts Robb Engen, Sandi Martin and Jackson Middleton discuss relevant finance news, topics and issues with some of Canada's leading financial personalities.

Source: http://becausemoney.ca/

Here is a list of the resources we used for this episode! And go. Jackson: Hey everybody, welcome to another episode of The Because Money Podcast. This is Episode 27, the most exciting episode we've had so far. And with that, I've got nothing else to say and I'm turning it over to Robb Engen.

Special guest Alexandra Macqueen Alexandra Macqueen is a Certified Financial Planner, retirement income specialist, co-author of the (soon-to-be) newly revised book Pensionize Your Nest Egg, and very gracious about usually being the smartest and most articulate person in the room (or online forum). She's @MoneyGal on Twitter.

It's our last episode of 2014, and - in the spirit of the coming New Year - we're talking budgets. The Christmas bills are about to start rolling in, which means 'tis the season for resolving to control your money this year.

Teaching Kids About Money

On episode 24 of the Because Money Podcast we are joined by Caroline Munshaw and Jenni Bolton of Cent$ible Students. They are self-proclaimed "money-moms" and work with kids in the school system from K-8 teaching financial literacy. Transcript: Jackson: Jackson Middleton Robb: Robb Engen Sandi: Sandi Martin Jenni: Jenni Bolton of Cent$ible Students Caroline: Caroline Munshaw ...

Anonymous Advice | Value of Simple.

This week we are joined by John Robertson PhD to discuss the credibility of online anonymous financial advice. Also John gives some highlights from his new book "The Value of Simple" to be released in early December 2014. Transcript John: Guest John Robertson PhD Robb: Robb Engen Sandi: Sandi Martin Jackson: Jackson Middleton Robb: Welcome to ...

How Cool is it that Ellen Roseman is on our show!

Lots of moving parts in episode 22 of the Because Money Podcast. Special guest Ellen Roseman was fabulous to talk with, I bet we could have talked for hours about consumer protection and financial literacy. You can either click play on the video above, sit back and relax and take in the show or you can read ...

What is Wealthsimple?

We had a lot of fun recording this episode of the because money podcast. Michael Katchen from Wealth Simple shares his vision of where the financial services industry in Canada will be going. The video pretty much speaks for itself, however if you are more of a reader, the transcript has been provided below!

Side Money.

Sometimes cutting costs just doesn't cut it - sometimes you need to make more money. This week, the King of the Side Gig Robb Engen talks about how to make the magic happen.

Insurance Nightmares.

In which we complain about our various run-ins (some of which are ongoing) with Ye Olde Insurance Company.

Travelling on the Cheap.

Apparently everything you need to know about travelling on the cheap starts with www.airbnb.com

Generation Y and Mindless Home Buying.

With Special Guest Rob Carrick << Seriously! Rob Carrick is joining us for this week's episode, and we're excited! We're talking real estate, how to tell if you can REALLY afford that house, job prospects, and - depending on fast we talk - if Gen Y really does have it worse.

How Do You Teach Financial Literacy?.

Special Guest Kyle Prevost We can all agree there's a need to teach financial literacy so that we can make informed and responsible decisions with our money. The challenge is how and where to implement financial literacy teachings and concepts. After the financial crisis in 2008-2009, the federal government launched a financial literacy task force ...

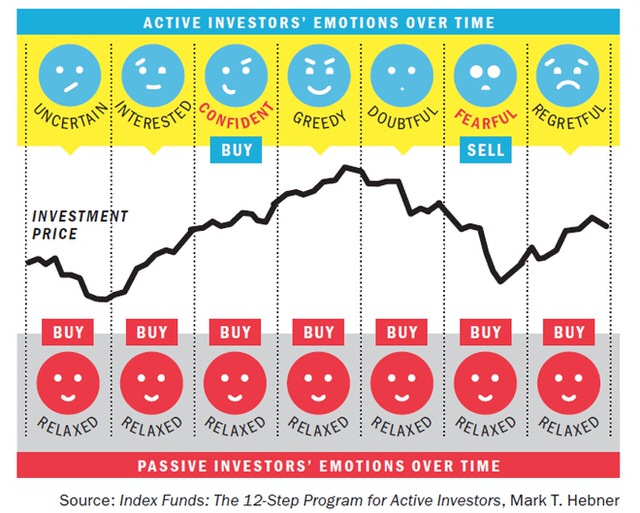

How Not to Be Your Own Worst Enemy,

Special Guest Dan Bortolotti Even the most steadfast investors can fall victim to their own destructive behaviour when it comes to managing their money. We tend to be overconfident and take on too much risk with our investments. We toss aside a carefully thought out investment plan the moment Mr. Market decides to have a temper ...

Why You (Yes, YOU) Should Care About How Financial Advice is Regulated | Because Money.

We're stepping up on the soapboxes this week and using the dreaded SH word at you: should. You should care about how financial advice in Canada is regulated, even if it means sacrificing some time waiting for the next season of Doctor Who or Downton Abbey or whatever it is you watch.

There Are No Bad Apples, Just Bad Barrels.

CBC Marketplace | Show Me The Money [Indeed] with Special Guest Preet Banerjee This week we will be discussing the CBC Marketplace Piece - Show Me The Money! Should be a lot of fun... because well Preet Banerjee (who is in the video) is on the show...

How Rewarding are Rewards Cards Really?

Credit cards are making you fat and stupid...or maybe they're making you better off, earning you money and rewards while buying stuff you were going to buy anyway...or maybe they're making small business owners poorer... We think it's a mix of all three, and - just like last week's Home Buyer's Plan debate - there's ...

Home Buyers Plan.

RRSPs to fund a Downpayment? Good or Bad? Being that it is getting close to tax season (some argue tax season is already here), expect to see a lot more conversation about RRSPs. Of note lately is talk that the Home Buyers Plan is more of a downpayment loophole than anything.

The Fellowship of the Andex Chart.

This one is so good, it doesn't need a description, seriously... just watch the video. However I needed to enter text here so that it didn't stick out as lacking in text.

I Can't Afford to Not buy It.

How Canadian Economic News Impacts You No guests this week, instead you are stuck with us talking about what is making news in Canada this week. As usual, if you would like to join the conversation, don't hesitate to jump in using the #becausemoney hashtag on twitter.

Borrowing Money Isn't Your Sacred Right as a Canadian.

Special Guest Holy Potato or John Potato or John Robertson PhD. On this week's podcast, we've coerced the holiest of spuds, scientist, and all-around nice guy John Robertson to take us to math school, to dig behind the headlines that scream "37% of Canadians are borrowing 13% more money than 43% of Canadians who aren't", and to generally be a deep thinking ...

Time Travel, How My Stupid My Past Self Won't Listen To Me and Weddings.

Special Guest joins us for episode 7. January: month of snow, wind, more snow, snow days, unplowed sidewalks...and weddings. Forget June, January is the real wedding season, full of wedding shows and blowout dress sales. We talk about it all! A must watch if you are planning a wedding soon!

Return of the Small Business Owner.

Are you a small business owner? Do you have your hand in the till? Thinking of starting a new business? Should you finance your startup with credit? These are just some of the questions we answered on this week's episode of the Because Money Podcast.

The Fees Strike Back.

We all hate paying fees and try to avoid them where we can, but some are worth paying because they add value/save time/give peace of mind. So our question to you! Which fees are worth the money? Also, the conversation might move towards managing your business finance much like you do personal finance...

A New Hope with Noel D'Souza.

Low-cost, Hand-Holding, Fairy-Godmother, Fee-Only Financial Planning This week were joined by special guest Noel D'Souza. In case you are wondering... it's pronounced "Know-ell"... now you know. What we discussed Lots on the agenda, conversation included the following: Does my mother need a fee-only financial planner? What the mutual fund industry isn't telling you!

Women, Money and the Will to Wave Hands.

What a great episode with our very first guest on the #BecauseMoney Podcast. Kerry K. Taylor who tweets @squawkfox and blogs at squawkfox.com joined us and we talked about everything! Seriously... Everything.